SPX Monitoring Purposes: Long SPX on 2/6/23 at 4110.98.

Monitoring Purposes GOLD: Long GDX on 10/9/20 at 40.78.

Long Term SPX Monitor Purposes: Neutral.

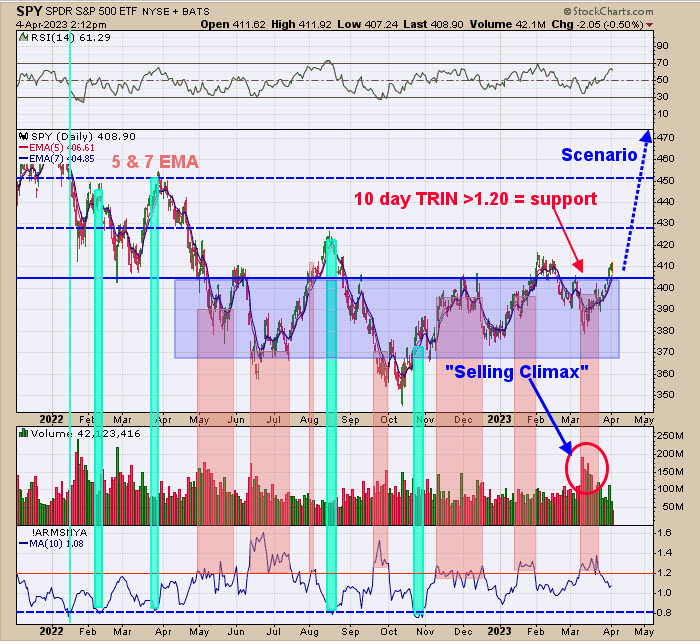

Above, we have the chart of the daily SPY. The pink area shows the times when the 10-day TRIN was above 1.20, a reading which shows panic and usually comes near lows in the SPY. The blue area shows when the 10-day TRIN is below .80, a reading that shows euphoria and normally comes near highs in the SPY. Right now, the 10-day TRIN stands at 1.08 and near-neutral reading for the market. If the rally continues (which we think it will), the 10-day TRIN may drop to .80 or lower and give us a “heads-up” that the market may be near a high and that may develop near 470 on the SPY. The purple area shows where most the 10-day TRIN reading was above 1.20, which was from the 370 to 405 range on the SPY and lasted 10 months, which in turn suggests a support area. This sideways pattern appears to be breaking out to the upside and giving a target to the 470 range, which is the January 2022 high. An interesting statistic: in pre-election years (like this year), April is up 94% of the time. If January was up (it was up over 6% this year), April is up 88% of the time.

The chart above is updated to today’s trading, but what we said yesterday is still relevant. “The breakout area on the monthly SPY chart is near the 405 level, which was exceeded on last Friday’s close. There was also a ‘Sign of Strength’ for the month on March (noted on the chart). The pattern that appears to be forming is a ‘Head-and-Shoulders bottom’ and has a measured target to the 470 level, which is the January 2022 high. The SPY didn’t quite get to the 50% retracement level, measured from the March 2020 low (50% level noted on chart). A 50% retracement suggests the market will at least rally back to the old high (January 2022 SPY 470) or can mark the half way point of the move up, which would give a much higher target. The bottom window is the monthly Slow Stochastic, which turned up last November and suggests an uptrend was started back then.”

Tim Ord,

Editor

www.ord-oracle.com. Book release “The Secret Science of Price and Volume” by Timothy Ord, buy at www.Amazon.com.

Signals are provided as general information only and are not investment recommendations. You are responsible for your own investment decisions. Past performance does not guarantee future performance. Opinions are based on historical research and data believed reliable; there is no guarantee results will be profitable. Not responsible for errors or omissions. I may invest in the vehicles mentioned above.